The speed at which the COVID-19 pandemic caused supply chain disruptions is not just hypothetical. From toilet paper to sanitizers to packaged food – procurement and supply were disrupted for all as demand sky-rocketed thanks to panic buying. Such shocks and the ‘new normal’ are reason enough to overhaul legacy systems.

FOMO: Is the CPG industry ‘missing out’ on a unified data view?Achieving excellence in CPG trading and risk management

Digitalizing procurement for Consumer Packaged Goods (CPG) industry might just be the best idea since sliced bread. Why?

The speed at which the COVID-19 pandemic caused supply chain disruptions is not just hypothetical. From toilet paper to sanitizers to packaged food – procurement and supply were disrupted for all as demand sky-rocketed thanks to panic buying. Such shocks and the ‘new normal’ are reason enough to overhaul legacy systems.

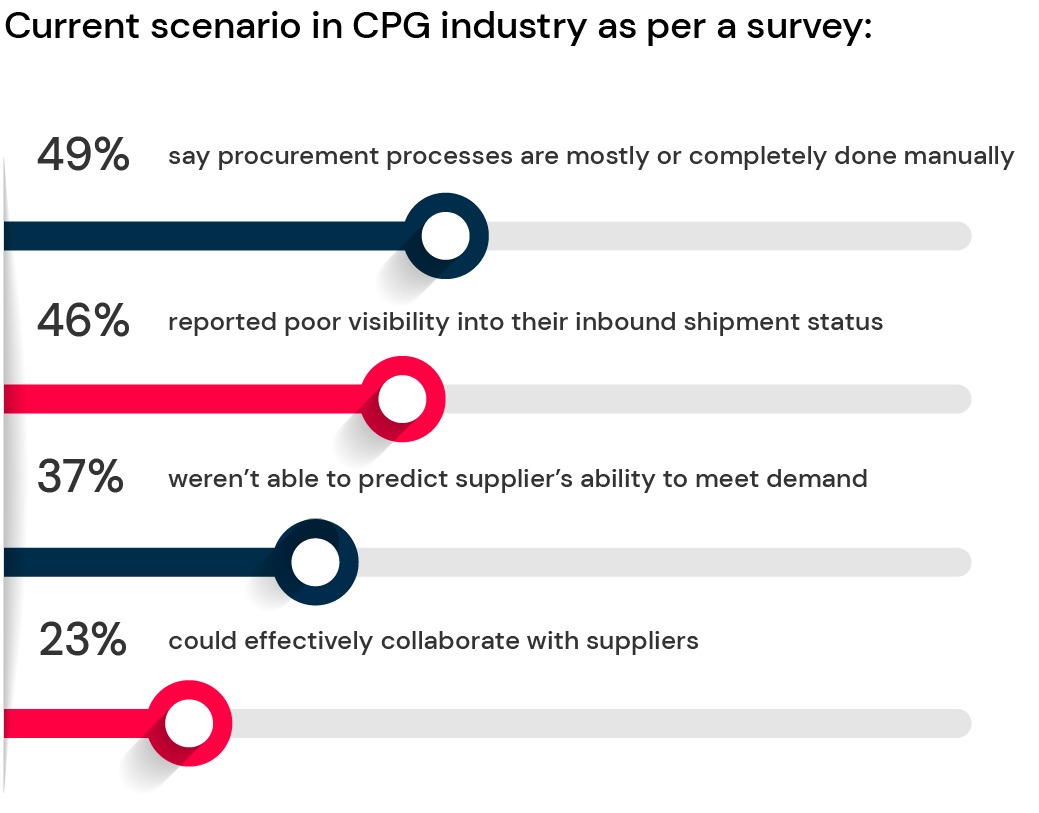

Currently, procurement teams are facing a host of challenges in the procurement process. According to a recent Oxford Economics study of CPG executives:

- 49% say that procurement processes are mostly or completely done manually

- 46% reported poor visibility into their inbound shipment status

- 37% weren’t able to predict supplier’s ability to meet demand

- Only 23% could effectively collaborate with suppliers

These challenges primarily stem from operating in a web of legacy, disjointed systems and spreadsheets that hinder timely visibility into the operations. To achieve excellence in trading and risk management, a unified data view of is critical for CPG companies.

Gaining visibility in CPG business through unified view of risk

Let’s take the example of a leading CPG company. The brand is among the top five largest Food & Beverage companies in the world, with a dedicated workforce in over 40 countries. The company owns eight brands making 1 billion dollars in business. Their net sales in 2020 alone was $26 billion.

Even though the brand has a worldwide presence and is exemplary as a CPG business, they still relied on disparate systems for their operations, and it was slowing them down. They spent significant time manually extracting data from multiple systems and using spreadsheets for critical business processes and analyses – financial trades (derivatives), settlements, close out, and P&L were handled in one system, while position and mark-to-market accounting was handled in a different system.

Their teams were manually extracting this data from each system and were using spreadsheets to manage their vast procurement and risk requirements, including spend and coverage against forecasted volumes, price risk for business units, hedge strategies and its effectiveness. This information was then manually fed into an accounting system for further processing.

Like all CPG companies, they too forecasted volumes of raw material to be procured a year in advance. This allows them to manage costs more efficiently. Despite a huge turnover, there is still ample potential to maximize profits if they focus on having a unified view of their business.

What a day in the life of a unified CPO office looks like

To understand why procurement teams would benefit from a unified view of data, here’s a typical scenario:

1. The executives set strategies and run macro simulations. New trades are entered into the system by the front office.

2. The middle office manager, named Louis, receives an email alert on trade breaching position limit.

3. Louis checks the position report and identifies the impact.

4. Louis posts a comment to Mike, head of front office, using the chat feature.

5. Mike from the front office makes the corrections immediately.

6. The back office reconciles the transaction and runs the report

Thanks to the unified data view, Mike and Louis from the procurement team are able to work together with other offices. This provides them with enhanced efficiency, control and timely action.

Enabling better business outcomes with technology for CPG companies

Finding the right technological infrastructure to support CPG trading and risk management is imperative. Investing in cloud-driven solutions can help procurement teams in CPG companies get a unified view of their risk. These solutions can successfully break the data silos that companies face and can help in gaining a holistic and an accurate view of their risk at one place.

With cloud-driven solutions, it’s also possible for leadership to access critical insights through sophisticated analytical dashboards in desired format at any point in time, using role-based logins. With the right solution, companies can get the benefits of risk monitoring, customized reporting, derivative trading and position & mark to market under the same umbrella.

Conclusion

To sum up, CPG businesses can greatly benefit from digitizing their procurement operations. Modernizing their technological infrastructure can help in a broader operational-improvement effort. The Eka platform definitely aces these parameters and could be the right cloud-driven solution to support the needs of the CPG business and provide a unified view into data, acting as a real-game changer.

Other resources

Managing risk and regulatory compliance in your CPG manufacturing supply chain

Markets are volatile, risk-prone, and complex even in the best of times. The pandemic has, however, pushed risk management to…

5 Key considerations to boost CTRM adoption by the team

The right CTRM solution brings massive business value thanks to the benefits of better collaboration and access to a centralized source of data.