Commodity markets are volatile, driven by our increasingly volatile world. It was seen that even over 6 months after the pandemic hit, businesses were yet to recover from its unprecedented impact that exposed them to several risks across the trading value chain.

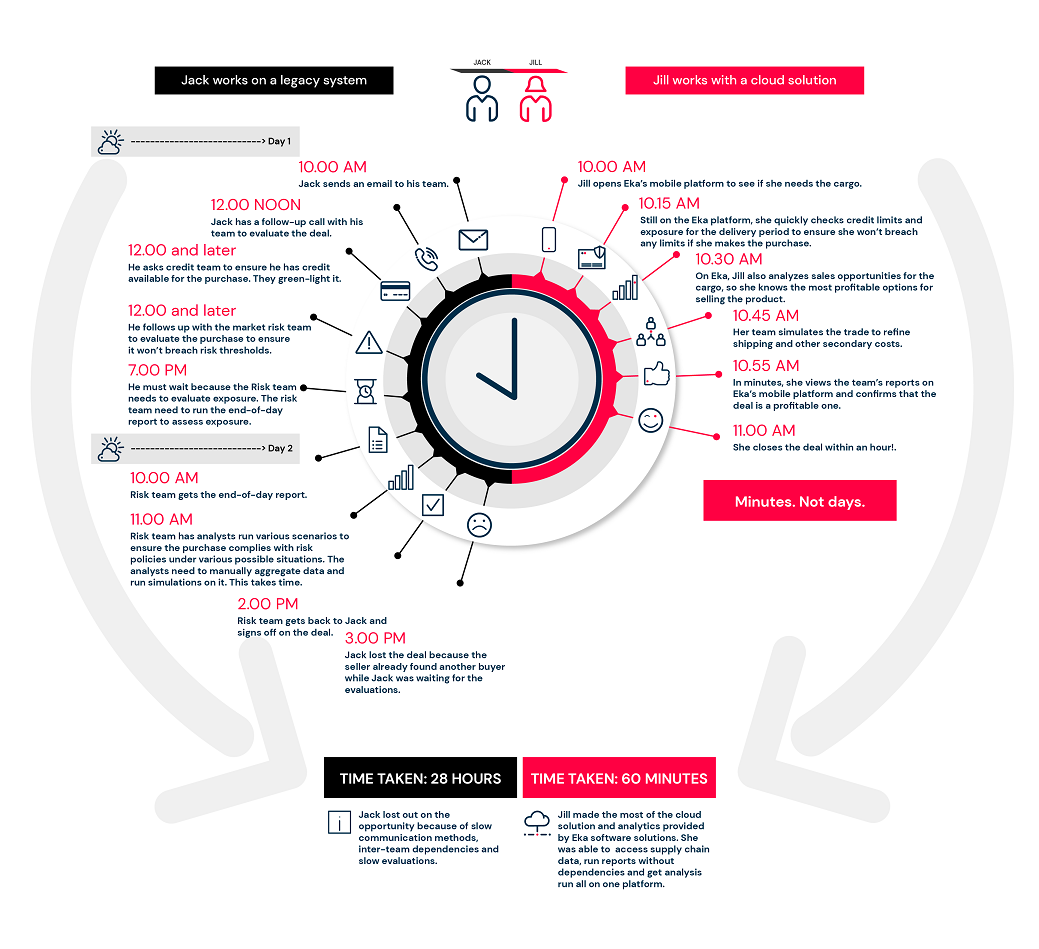

Legacy CTRM costs time, creates lost opportunities

Commodity markets are volatile, driven by our increasingly volatile world. It was seen that even over 6 months after the pandemic hit, businesses were yet to recover from its unprecedented impact that exposed them to several risks across the trading value chain. Besides Covid-19, commodity markets are susceptible to a myriad of events, climate changes, geopolitics, trade wars and shifting regulations to name a few.

Businesses today need sophisticated and cloud-driven flexible CTRM solutions and yet most continue to rely on legacy CTRMs and spreadsheets. According to a survey of over 100 medium to large manufacturers, more than 95% of the companies involved in commodity trading we have spoken to run some or all their commodity risk on spreadsheets.

These systems are also poorly integrated across the organisation reducing visibility and are not equipped with technologies such as AI, analytics, automation and blockchain that not only help reduce the overall complexity of managing commodity trading and risk but also help businesses stay future-ready.

The problem with legacy CTRM software

Legacy commodity trading risk management software was designed to handle the complexities of commodity trading 20 years ago. Just as markets have become more volatile in the past 20 years, technology has evolved at an astonishing rate, making 20-year old systems obsolete. With the advent of real-time data, machine learning, AI, mobile, and cloud, the opportunity to move with markets was born. Commodity trading companies that want to grow in challenging markets need to take advantage of it.

Read the white paper to learn more about the evolution of commodity management.

First mover advantage – real-time alerts

One of the features Eka built into its could-driven CTRM platform is real-time alerts. With real-time alerts, you don’t have to actively monitor all the key thresholds in your trading business – risk limits, price shifts, inventory levels, etc. Instead, Eka platform monitors your user-defined thresholds and the system tells you when there is a breach. The system is always on, always watching.

Take, for example, two manufacturing companies in the same region each procuring sugar to manufacture baked goods. Suddenly, political upheaval drives the price of sugar up 100% at 12:00 pm – while traders are at lunch. The two manufacturers will both learn about the price shock, but the manufacturer with real-time alerts will learn immediately, perhaps hours before his slower competitor. In those hours, the faster manufacturer has time to run scenarios, evaluate other sources for sugar, talk to suppliers, and make some decisions. New contracts could be developed and signed before the slower competitor even knows about the problem.

Analytics on demand

The power of mobile is the ability to gain insight anytime, anywhere. Imagine our two manufacturers, but this time they both receive news of the price shift while at home. Our first manufacturer – with an analytics-driven Eka cloud platform – has access to all analytics, insights, and reports on his phone. The system is 100% cloud-based and 100% mobile. So, Manufacturer 1 can immediately run simulations, analyze the impact of the price shock, share reports with teammates via the chat feature, and start making decisions – all from his phone.

Manufacturer 2, with an old CTRM system, cannot move as quickly. First, his old CTRM system may not even have analytics he can use, so he may have to start by contacting analysts. Then, the information may not be readily available, because not all systems have connected data. So, he may have to contact the analysts then wait for them to collect and analyze the data. Meanwhile. Manufacturer 1 has already assessed the impact, talked with his team, and made decisions to avert disaster.

The cloud platform of Eka provides real-time mobile access with user-friendly interfaces and integrates all your data on one platform to ensure you have the information you need when you need it. You never waste time aggregating data because the data is all in one place.

Self-serve reporting

The power of self-serve reporting cannot be understated. When commodity markets move fast, you don’t have time to wait for an analyst to review your question, aggregate data, analyze data, create reports, and then share the reports with you. What if you have a follow-up question? Do you need to start the entire process again?

If your business needs to move fast, then you need the ability to get answers to questions fast. What if the price reaches threshold A? What if it falls? What if the hurricane makes landfall in Florida? How does your business change if it misses Florida and hits Georgia? If you need answers fast, you need to be able to access the data and create the insights yourself – which requires a simple UI, real-time access to all your data, and embedded analytics.

There are many more examples of the advantages of using modern CTRM software, including how AI and machine learning improve decision making, how the cloud enables faster implementation times, and how you can drive profits by customizing the perfect CTRM system for your business. If you want to compete in today’s volatile markets, it’s time to take advantage of modern technology with the cloud-based Eka CTRM solution.

Read our App sheet to find out more about risk monitoring.

Other resources

Overcoming the visibility roadblocks in your risk and compliance

According to Commodity Technology Advisory Report, 80% of companies continue to use traditional, on-premise systems that don’t provide real-time visibility into data.

10 ways to know if you’ve outgrown your CTRM system

CTRM systems were developed to replace spreadsheets and home-grown systems that commodity trading companies were using for trade and risk management.