It’s hard to imagine now, but there was a time when technology wasn’t at our fingertips. Implementing any technology for business purposes was no less than a nightmare – the process could take months, i.e., if the implementation was successful in the first place.

Looking for a SaaS based commodity trading platform in 2022?

It’s hard to imagine now, but there was a time when technology wasn’t at our fingertips. Implementing any technology for business purposes was no less than a nightmare – the process could take months, i.e., if the implementation was successful in the first place. Working with on-premise technology made sharing, collaborating, analyzing, and storing data tedious. All this changed when Software as a Service (SaaS) gained momentum.

And just like that, users could implement any business technology they needed with a few clicks and at a fraction of cost. It’s safe to say now cloud has changed the technology game for good. Now in 2022, it’s becoming increasingly hard to fathom a world without cloud where data is inaccessible.

Quick view into SaaS based commodity trading

Commodity trading – the new kid on the SaaS block (relatively speaking)

Although the commodity industry has been late to the SaaS party, it’s picking up fast. This phenomenon is evidently a result of the pandemic when businesses were left with no choice but to adopt cloud for greater speed and flexibility, and not to mention remote working.

Historically, CTRM system implementation used to be a costly affair. This meant that companies who couldn’t shell out millions of dollars, like mid-sized companies, were left with limited choices and would resort to spreadsheets to manage their trading operations. Cloud solutions driven by SaaS changed that. SaaS provides ease of use and affordability in one go. Thanks to cloud-based platforms, any company regardless of its size can benefit from SaaS CTRM at a fraction of what it would cost earlier.

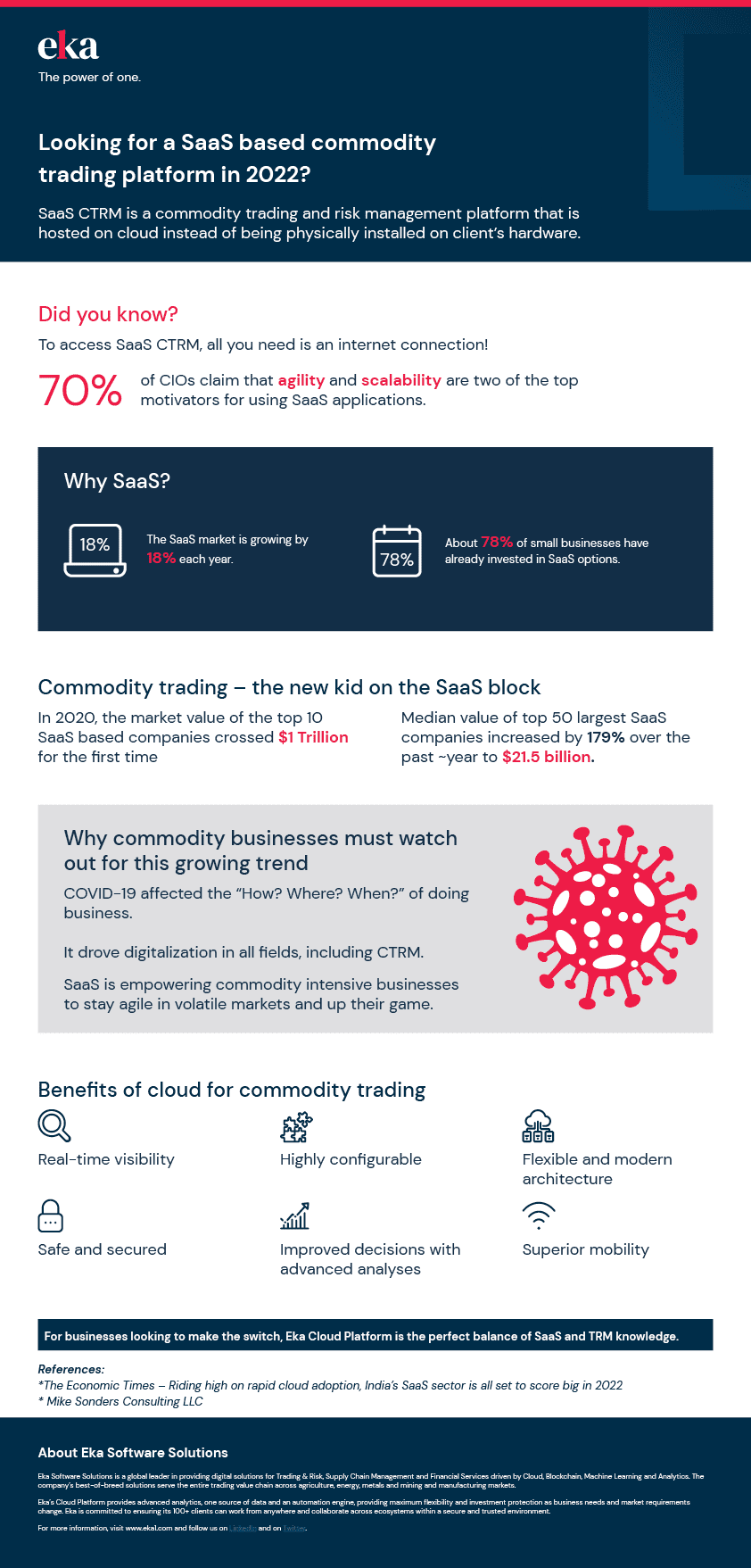

Here are some important SaaS statistics to keep an eye on:

- The SaaS market is currently growing by 18% each year

- 99% of organizations will be using one or more SaaS solutions by the end of 2021

- Approximately 78% of small businesses have already invested in SaaS options

- SaaS adoption in the healthcare industry grows at a rate of 20% per year

- 70% of CIOs claim that agility and scalability are two of the top motivators for using SaaS applications

*Source: The Economic Times – Riding high on rapid cloud adoption, India’s SaaS sector is all set to score big in 2022

In 2020, the market value of the top 10 SaaS based companies crossed $1 Trillion for the first time, as per a report by Mike Sonders Consulting LLC. The median value of top 50 largest SaaS companies increased by 179% over the past ~year to $21.5 billion. Commodity businesses need to keep eye on this growing trend. Why? Because not only has it led to an overhaul in business-as-usual in commodity trading, but it has also helped businesses up their game.

For the uninitiated, commodity trading is the exchange of different assets, typically futures contracts, that are based on the price of an underlying physical commodity. With the buying or selling of these futures contracts, investors make bets on the expected future value of a given commodity. That’s where SaaS based commodity trading trends comes into the picture.

Why’s SaaS based commodity trading relevant now?

COVID-19 affected the “How? Where? When?” of doing business. Since hybrid work is here to stay, companies are also making the logical switch to systems that provides their workforce the freedom to access data from anywhere, any time. It has forced companies into digitalizing workflows, long managed manually, and made cloud the hero of the day for easy collaboration, analysis and most importantly data accessibility.

The financial-trading space is no different. Cloud products like trading software will be the future and on-premise trading platforms will be a thing of the past. This essentially means that enterprises can accomplish critical key trading operations seamlessly and enjoy many benefits. Here are a few –

Benefits of cloud for commodity trading

- Real-time visibility

A SaaS-based commodity platform provides real-time access and integration of data. This helps provide better visibility and makes room for faster analysis; ultimately leading to optimal decisions.

Example: Procurement teams long relied on manual process including hundreds of emails, faxes, phone calls and physical documentation when working with suppliers to source materials. With Eka Cloud Platform, the entire process is digitalized where teams can negotiate in real time, work through contracts and pricing instantly instead of waiting hours or days to return phone calls or emails. This saves valuable time in the negotiation process and provides a higher level of visibility that benefits suppliers, procurement teams and trading partners. - Can be customized according to needs

Some companies trade with a single commodity while others deal with multiple. If it’s the latter, it is ideal to choose a vendor that provides one solution to handle the nuances of multiple commodities. Sometimes, even a single commodity requires a complex solution.

Example: Trading in a soft commodity such as cotton needs a higher capability system. The reason for this is that cotton has more than 12 distinct quality characteristics that impact its pricing. Modern, cloud driven CTRM solutions such as Eka let users leverage its low-code/no-code build to configure new capabilities without any IT support and benefit from faster ROI. - Benefit from modern architecture

Get speed and scalability at the fraction of traditional CTRM cost. Case in point, when it comes to agriculture, Eka’s trading and risk management solution for agriculture provides businesses the flexibility to scale with the market by configuring newer functionalities in the form of nimble yet powerful applications without investing in a full-fledged CTRM system. - Data remains safe and secure

There’s no need to be concerned about CTRM security. Cloud platforms come with safeguards like data encryption, role-based security as well as cloud security. These are the fail-safes that legacy systems are yet to catch up with and help eliminate data breaches. - Aggregate and analyze data with ease

SaaS-based systems given their plug-n-play design let users collect, integrate, and manipulate data like no other. This helps commodity businesses to gain timely visibility across their operations and make more informed decisions.

Example: Companies that hedge their risks need to pull data from various departments, systems and spreadsheets. Manually extracting this data is not only error prone but also time consuming. By the time they get complete visibility into their true exposure, chances are the market has already moved and opportunities missed. - Improved mobility

Since data can be accessed from anywhere, traders can be on-the-move and operate from any place or device. The current work from home scenario fosters the need to the applications to be accessed from mobile, laptops or tablets from any part of the world.

Conclusion

We’ve gotten used to the comfort and convenience that SaaS provides. For commodity trading, SaaS CTRM platforms can ultimately spell the difference between getting by and making profits. For businesses looking to make the switch, Eka Cloud Platform is the perfect balance of SaaS and TRM knowledge.

Other resources

5 Key considerations to boost CTRM adoption by the team

The right CTRM solution brings massive business value thanks to the benefits of better collaboration and access to a centralized source of data.

ERP system vs. CTRM - Don’t ignore these 4 key differences

When it comes to commodity trading and risk management (CTRM), will using your existing enterprise resource planning (ERP) software suffice? That is true ‘risky business’! Think twice before using them interchangeably.

The right CTRM solution brings massive business value thanks to the benefits of better collaboration and access to a centralized source of data.

When it comes to commodity trading and risk management (CTRM), will using your existing enterprise resource planning (ERP) software suffice? That is true ‘risky business’! Think twice before using them interchangeably.