Eka Treasury.

Eliminate uncertainty.

Gain visibility and control over your treasury and risk functions with aggregated data and integrated workflows.

Eka Treasury leverages best-of-breed technology to digitally transform your treasury and risk functions

By aggregating multiple sources of financial data and streamlining workflows across critical functional areas, leading companies are able to view and control cash, liquidity and risk positions as well as manage working capital, govern hedge accounting, and ensure compliance. Our unique composable and extensible platform gives you the freedom to escape disjointed legacy systems and gain a more accurate financial perspective.

Key capabilities for managing end-to-end Treasury

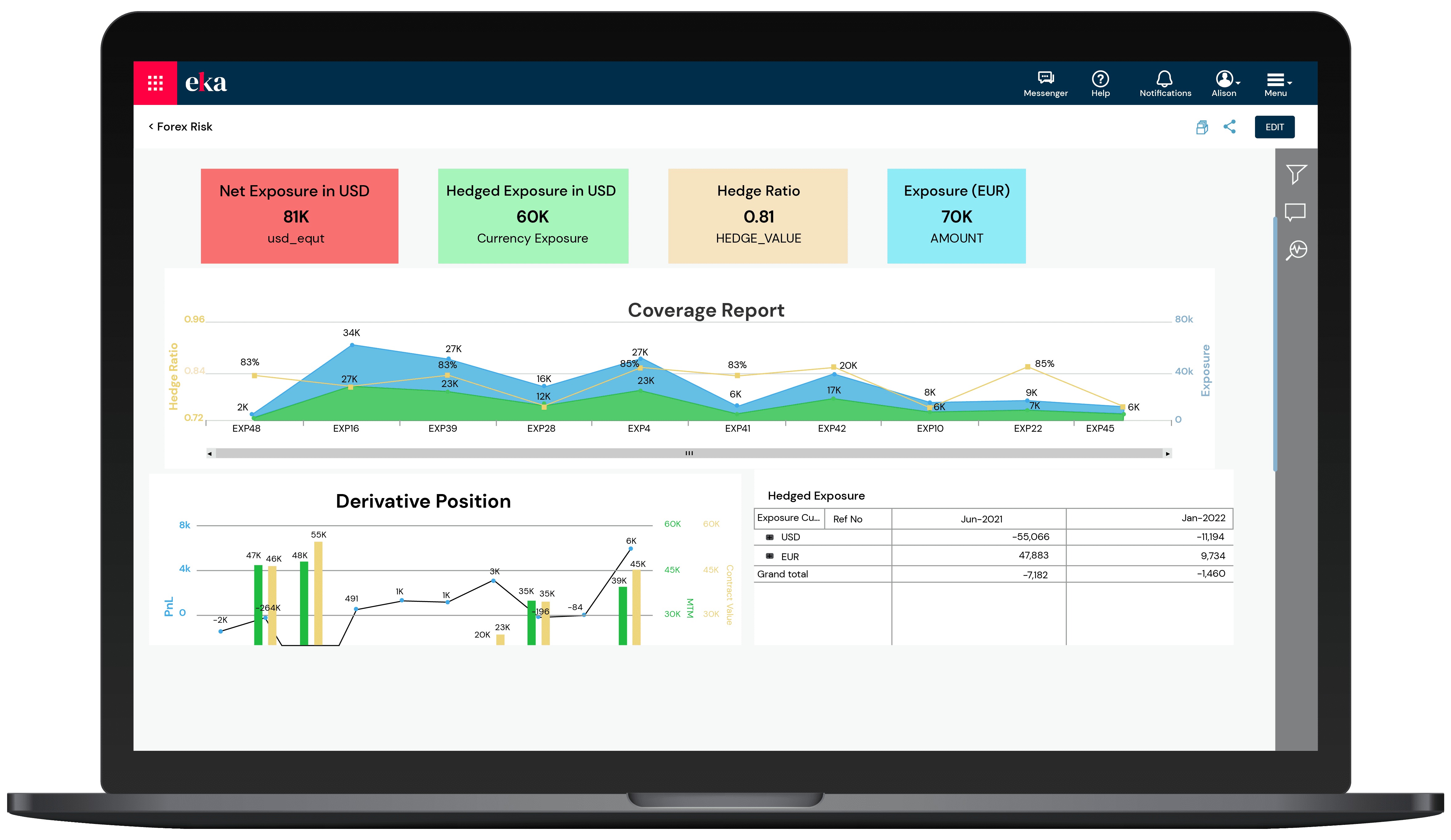

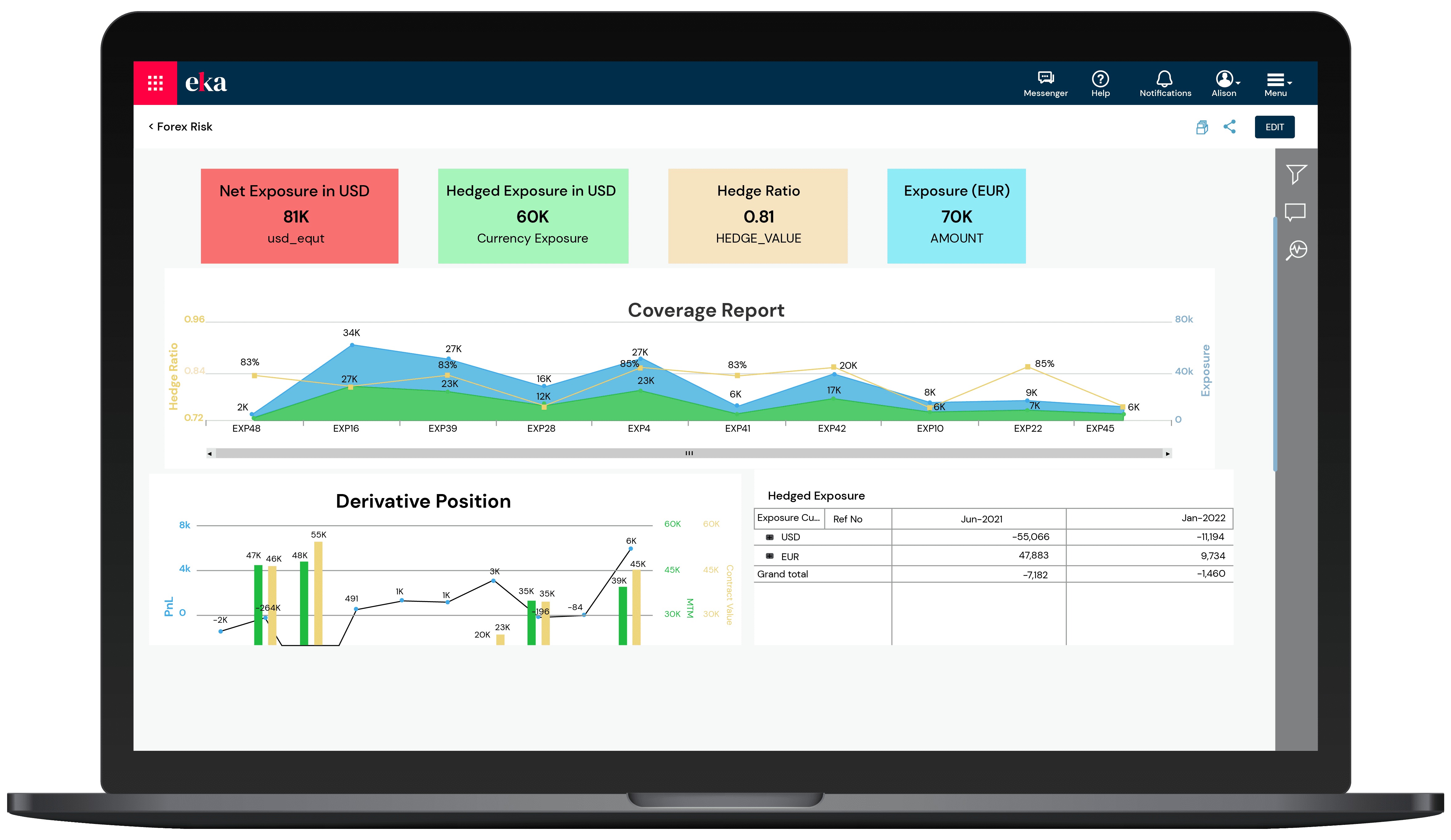

Measure and monitor your currency and interest rate risk exposure, evaluate the cost of hedging and improve your hedging strategy by effectively balancing future volatility and exposure uncertainty.

- Seamlessly connect the liquidity forecasts with your hedging strategy, perform what if analysis and measure level of coverage the derivatives offer

- View and structure the coverage at any level, be it netted by currency, profit center or any legal entity. Use our Mark to market engine daily or in real time to keep closer look at your hedge portfolio

- Simulate any scenario by applying various types of shocks and see it impact on your P&L. Use our Credit Risk app to understand and manage counterparty closely monitor counterparty exposure, credit limits and breaches

- Seamlessly connect the counterparty risk assessment to underlying AP/AR and ERP feeds and get a complete view

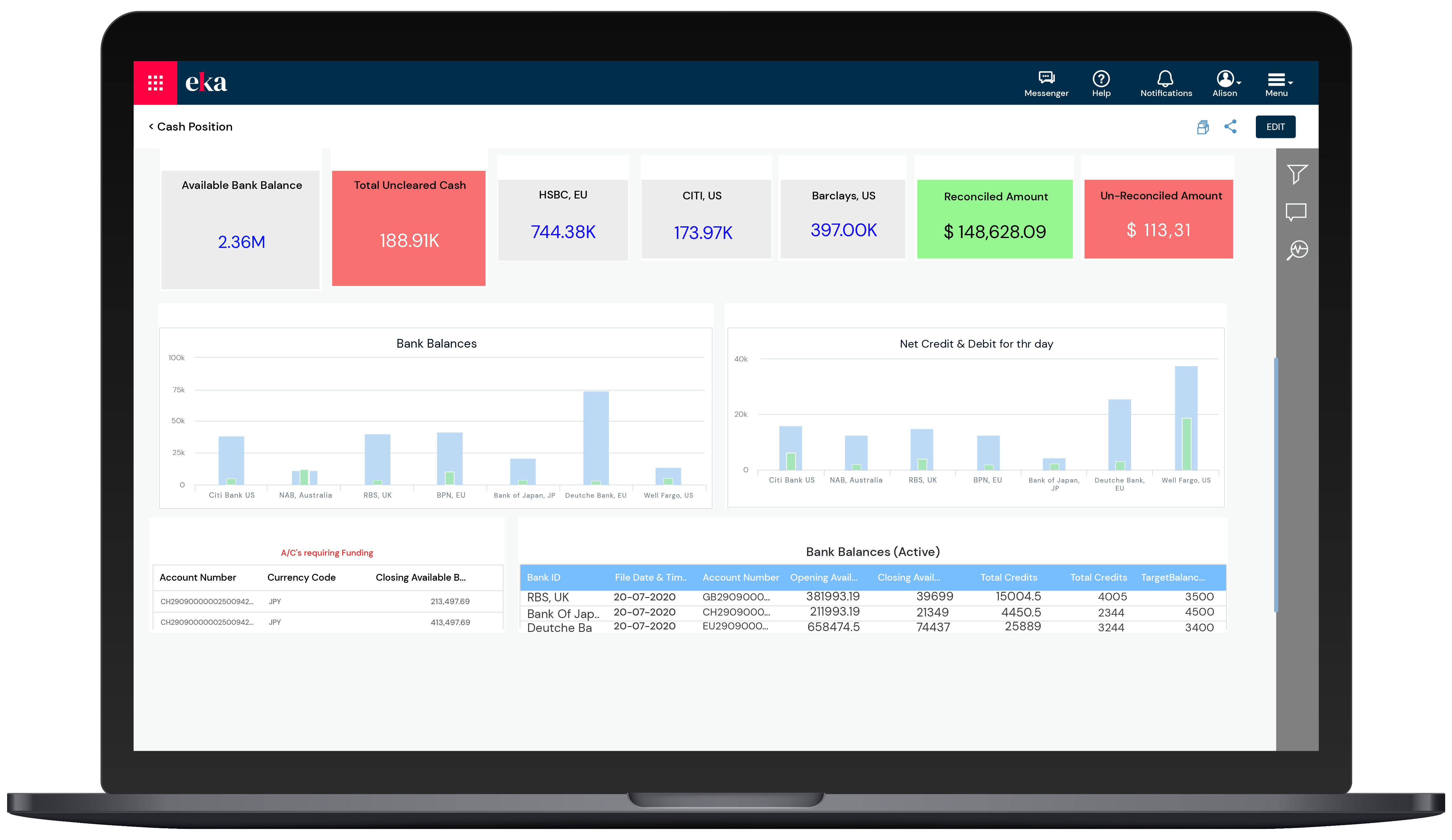

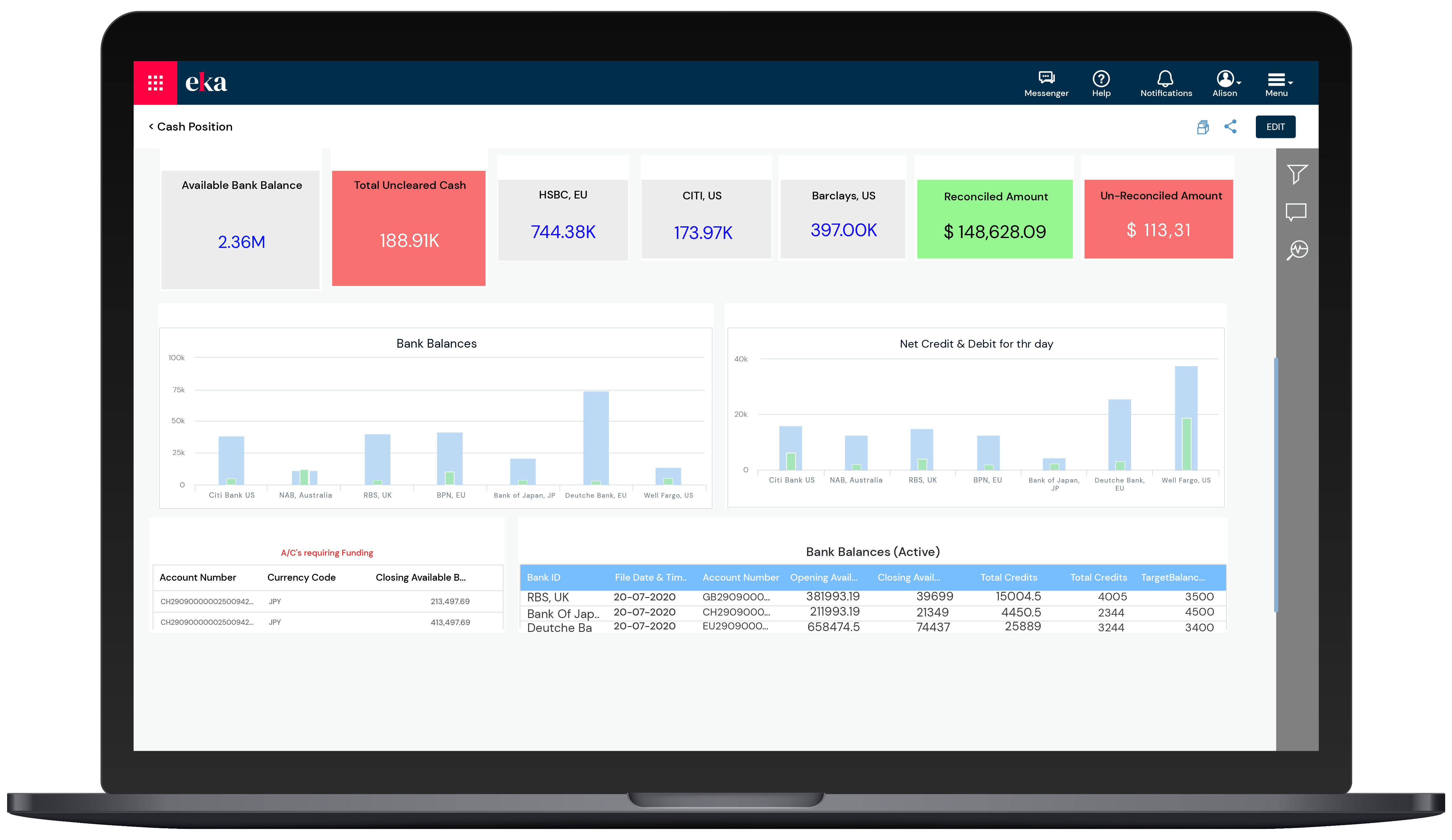

Aggregate disparate data from banks, ERPs, and excel sheets into Eka Treasury Platform for visibility of daily and real time cash position.

- Automate processes to eliminate manual mistakes and reduce your daily efforts, allowing you to update bank files as frequently as needed

- Reconcile bank statements with our powerful matching and rollover engine

- Automate anomaly detection using our platforms inbuilt anomaly detection engine

- Eliminate variances

- Share EOD reports with customizable dashboards organized by bank, currency, entity, profit center etc.

- Perform automated cash accounting

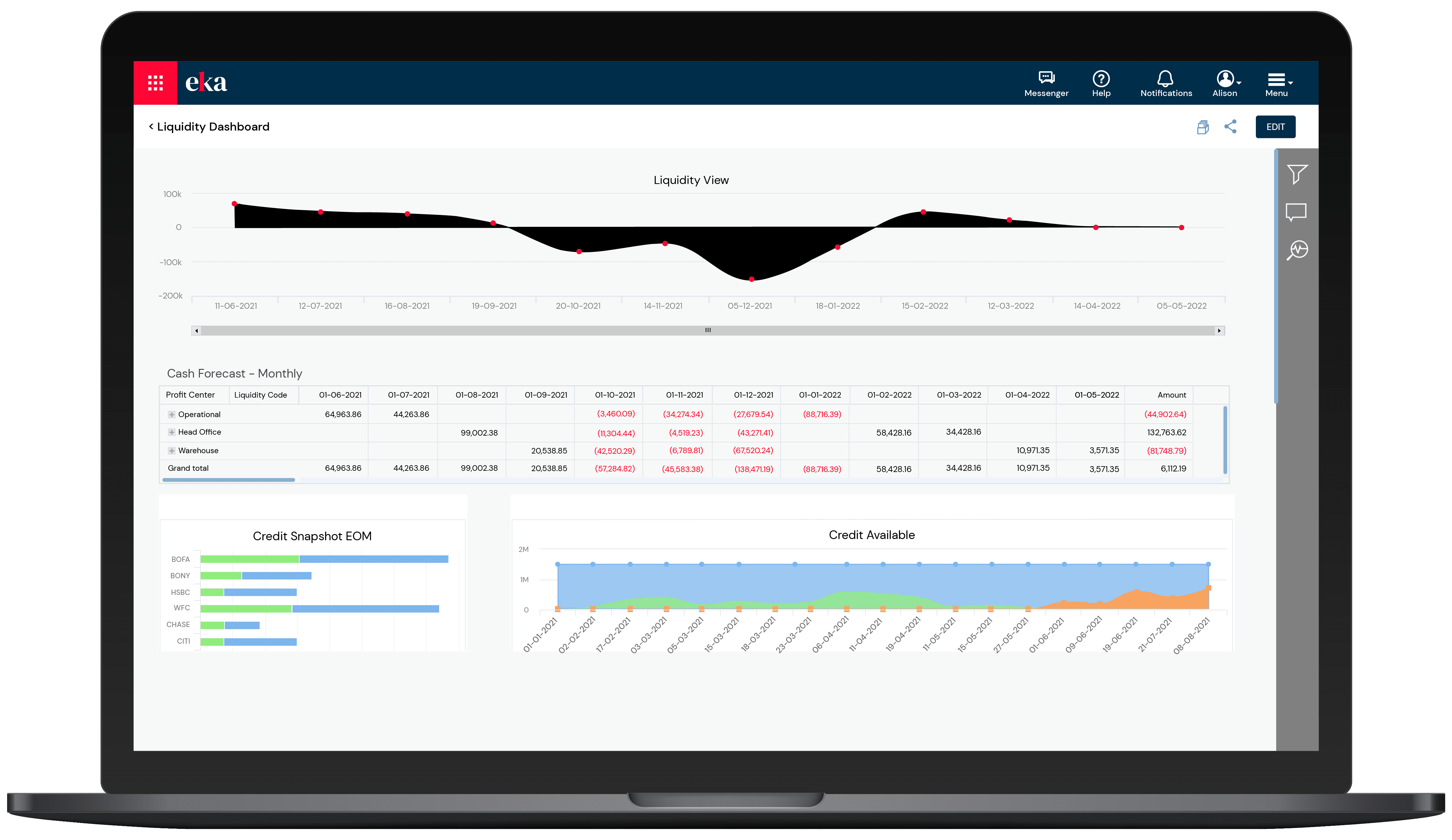

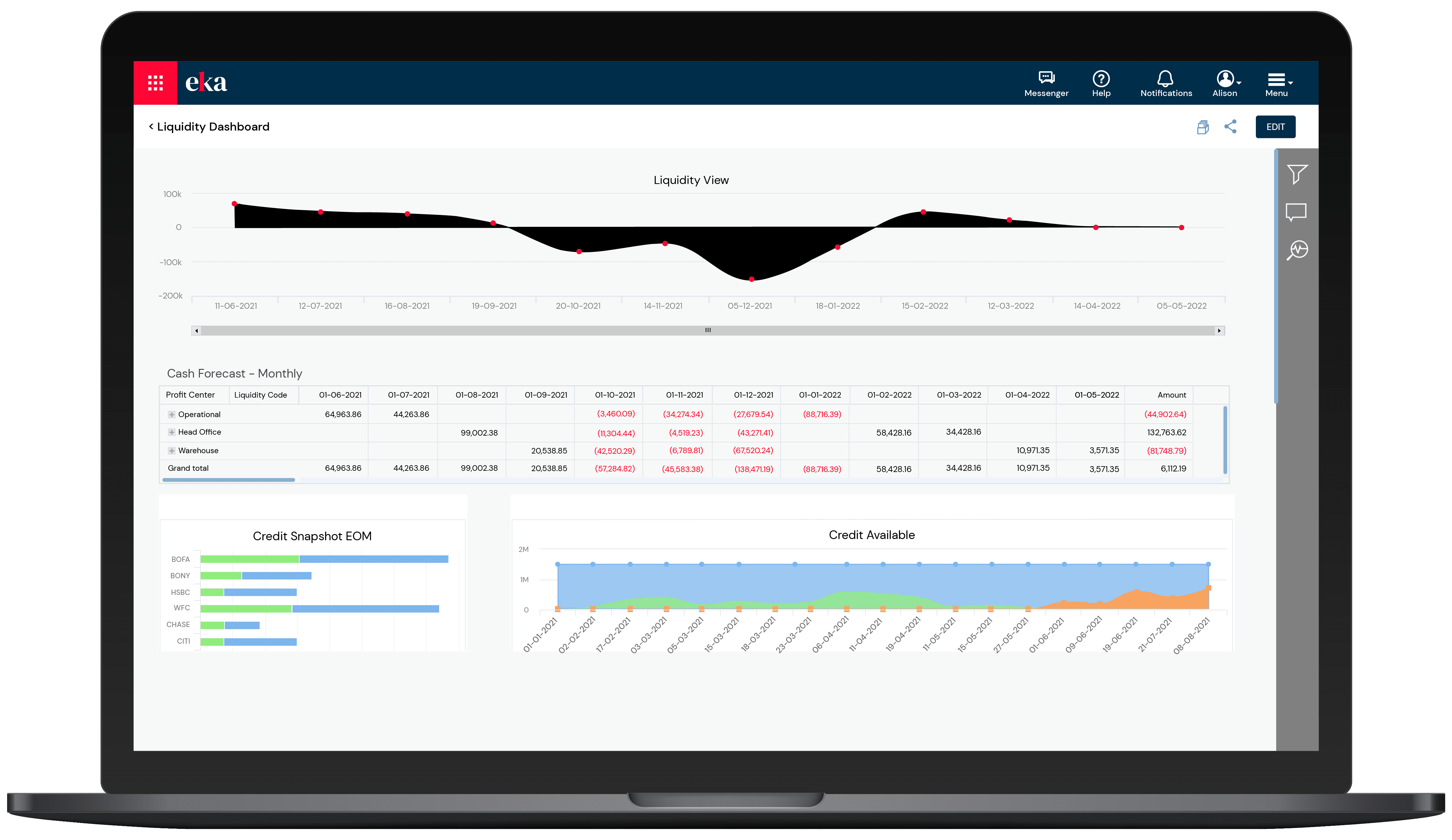

Get a unified view of your working capital structures, liquidity forecasts and hedge strategy. Our analytics-powered dashboard provides a 360-degree view of your liquidity and financial positioning.

- Easily source and combine several forecasts from your business units and perform various analysis and comparison against budget benchmarks, historical forecasts, custom liquidity plan etc. to detect anomalies

- Automated alerts and monitoring reduce delays, captures omissions, and proactively advises where to address mistakes

- Gain central visibility and control of your liquidity position

- Seamlessly connect to ERP and AP/AR systems

- Benchmark and track your performance against the KPIs

- Organize information by liquidity groups, region, currency, entity, timeframe, etc.

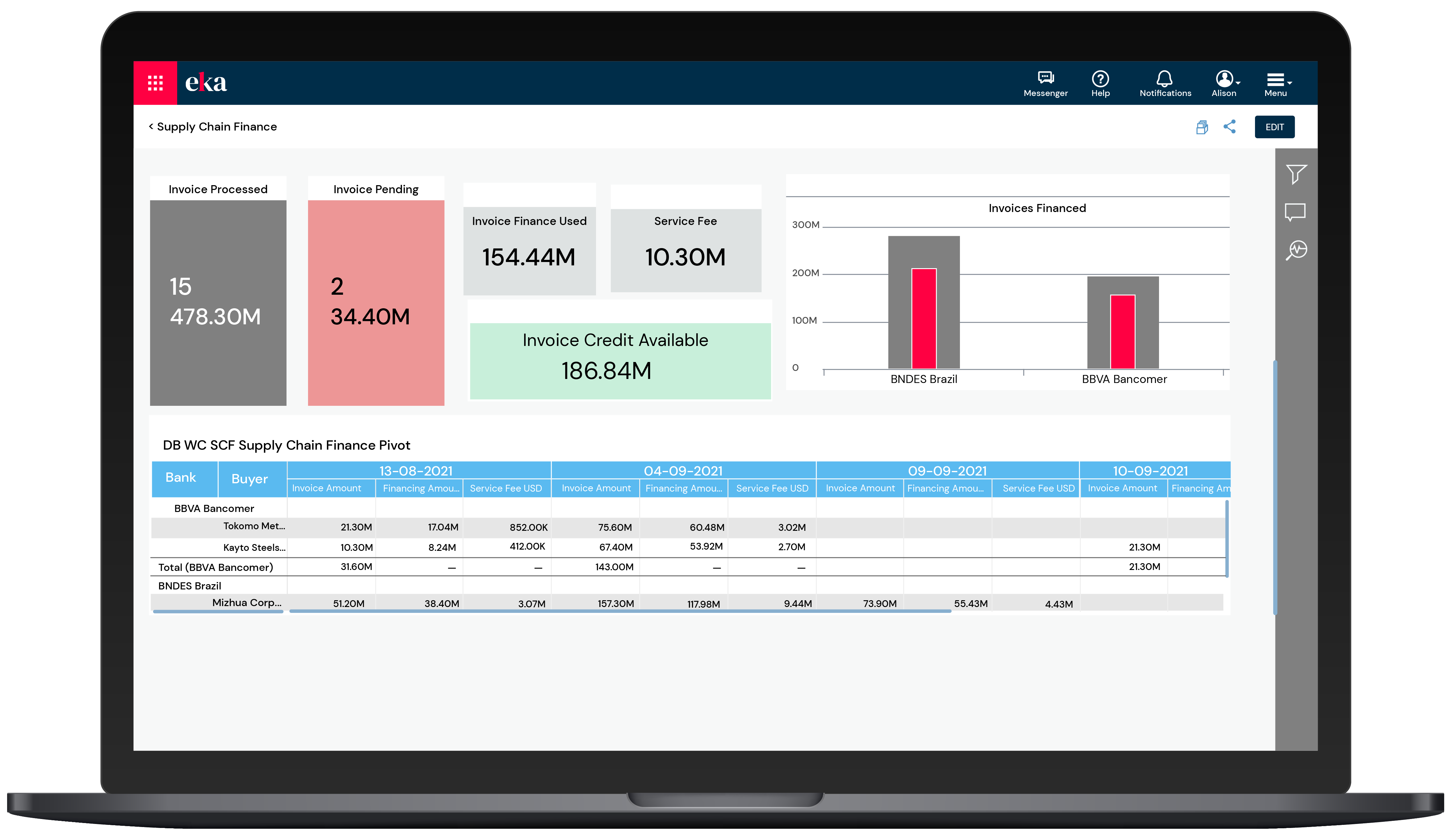

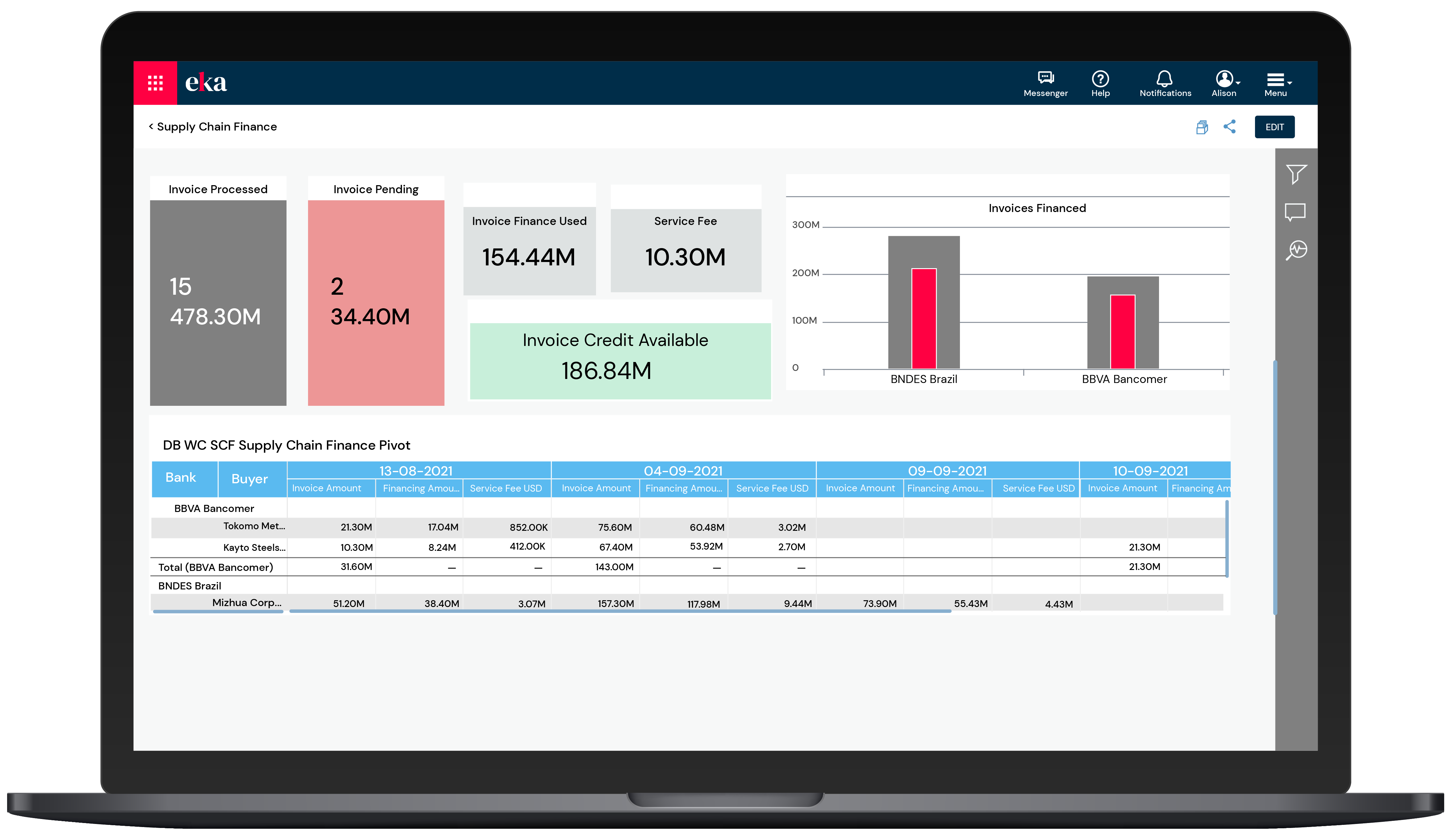

Our supply chain financing is a unique solution to manage your financing requirements. Our platform allows the buyers, suppliers, treasurer and procurement to collaborate and come up with a mutually beneficial financial arrangement to keep the cash fluid.

- Track all approved invoices and improve your borrowing capacity

- Manage the Invoices throughout the life cycle from Invoice credits to payments

- Compare and optimize borrowing options, multi bank funding

- Calculate supply chain finance efficiency, fees charged, credit ratings of buyer

- Buyers can track and negotiate Invoice due dates to free up cash

- Buyers can compare Invoice due dates across suppliers

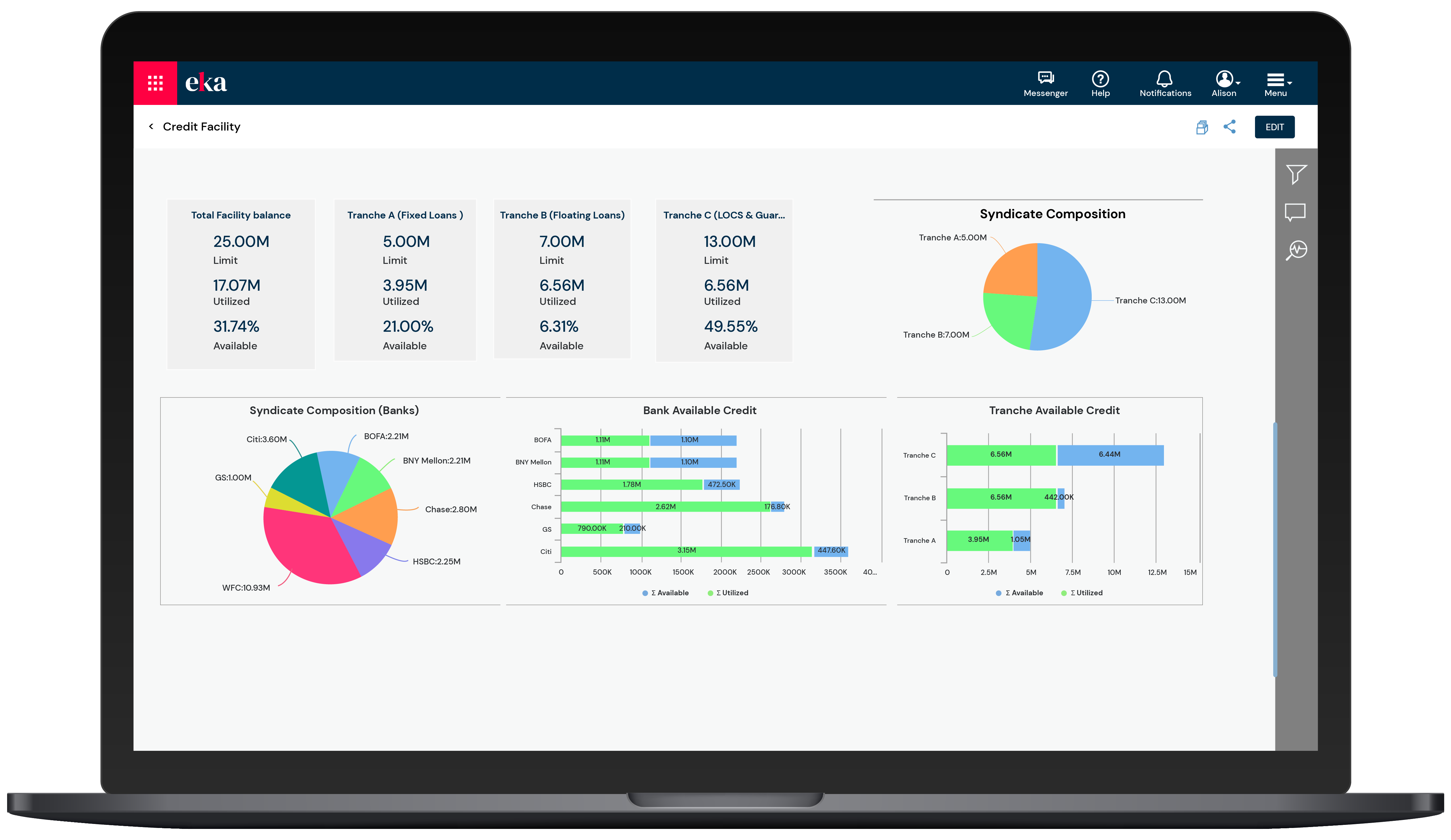

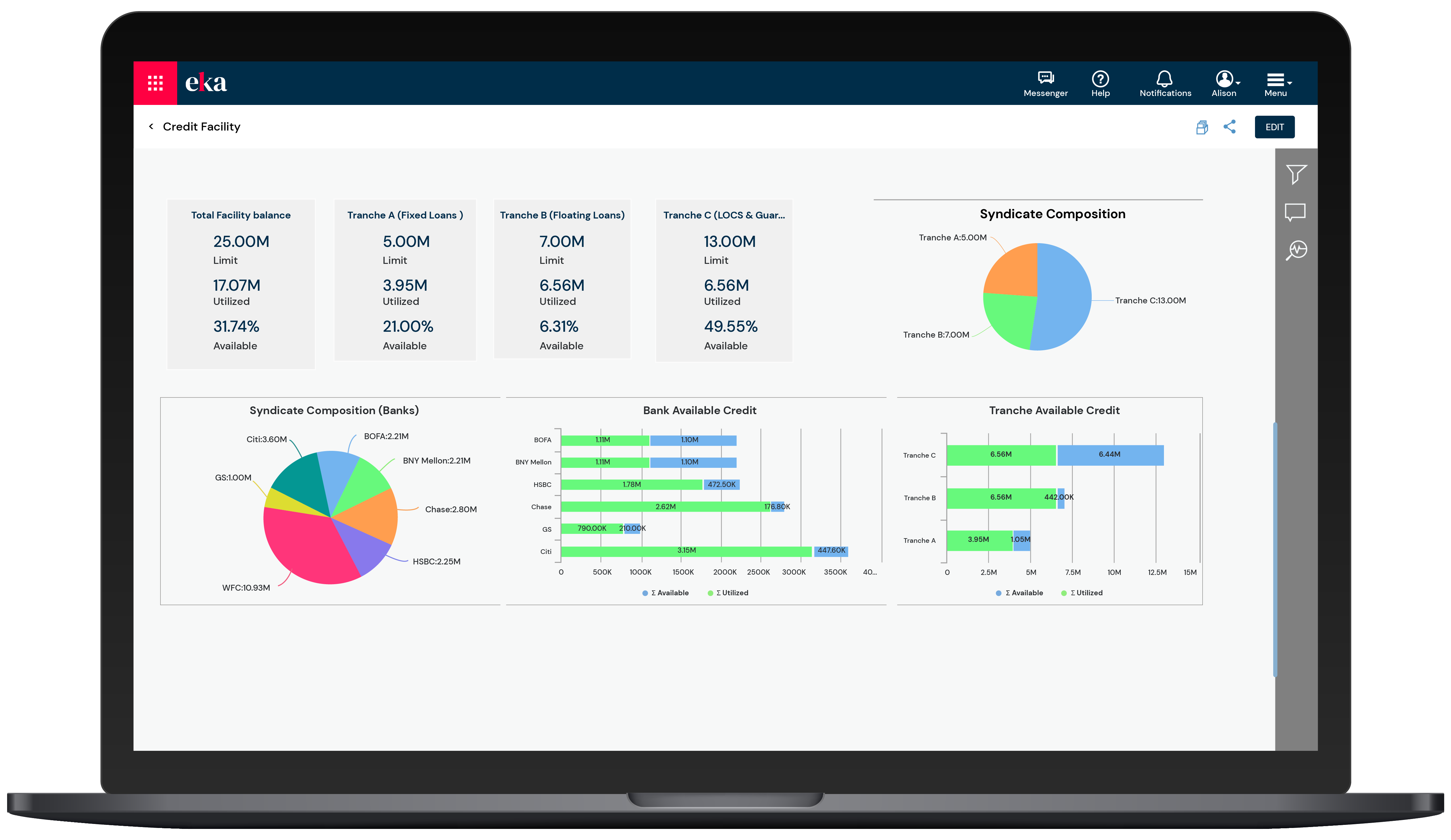

Use EKA treasury platform to that can accurately consolidate, track and optimize global working capital management transactions.

- Match your short term and long-term liquidity position against available loans and credit facilities

- Structure your working capital arrangement by using our range of credit instruments

- Perform what-if and scenario analysis to get a better sense of short term and long-term funding needs

- Track and monitor credit utilization and fee structure to balance credit availability with cost of borrowing for the most efficient credit structure

- Use our trade finance and supply chain finance apps to manage payment arrangement with your supplier

- Collaborate with your suppliers and bank counterparts

Measure and monitor your currency and interest rate risk exposure, evaluate the cost of hedging and improve your hedging strategy by effectively balancing future volatility and exposure uncertainty.

Seamlessly connect the liquidity forecasts with your hedging strategy, perform what if analysis and measure level of coverage the derivatives offer

View and structure the coverage at any level, be it netted by currency, profit center or any legal entity. Use our Mark to market engine daily or in real time to keep closer look at your hedge portfolio

Simulate any scenario by applying various types of shocks and see it impact on your P&L. Use our Credit Risk app to understand and manage counterparty closely monitor counterparty exposure, credit limits and breaches

Seamlessly connect the counterparty risk assessment to underlying AP/AR and ERP feeds and get a complete view

Aggregate disparate data from banks, ERPs, and excel sheets into Eka Treasury Platform for visibility of daily and real time cash position.

Automate processes to eliminate manual mistakes and reduce your daily efforts, allowing you to update bank files as frequently as needed

Reconcile bank statements with our powerful matching and rollover engine

Automate anomaly detection using our platforms inbuilt anomaly detection engine

Eliminate variances

Share EOD reports with customizable dashboards organized by bank, currency, entity, profit center etc.

Perform automated cash accounting

Get a unified view of your working capital structures, liquidity forecasts and hedge strategy. Our analytics-powered dashboard provides a 360-degree view of your liquidity and financial positioning.

Easily source and combine several forecasts from your business units and perform various analysis and comparison against budget benchmarks, historical forecasts, custom liquidity plan etc. to detect anomalies

Automated alerts and monitoring reduce delays, captures omissions, and proactively advises where to address mistakes

Gain central visibility and control of your liquidity position

Seamlessly connect to ERP and AP/AR systems

Benchmark and track your performance against the KPIs

Organize information by liquidity groups, region, currency, entity, timeframe, etc.

Our supply chain financing is a unique solution to manage your financing requirements. Our platform allows the buyers, suppliers, treasurer and procurement to collaborate and come up with a mutually beneficial financial arrangement to keep the cash fluid.

Track all approved invoices and improve your borrowing capacity

Manage the Invoices throughout the life cycle from Invoice credits to payments

Compare and optimize borrowing options, multi bank funding

Calculate supply chain finance efficiency, fees charged, credit ratings of buyer

Buyers can track and negotiate Invoice due dates to free up cash

Buyers can compare Invoice due dates across suppliers

Use EKA treasury platform to that can accurately consolidate, track and optimize global working capital management transactions.

Match your short term and long-term liquidity position against available loans and credit facilities

Structure your working capital arrangement by using our range of credit instruments

Perform what-if and scenario analysis to get a better sense of short term and long-term funding needs

Track and monitor credit utilization and fee structure to balance credit availability with cost of borrowing for the most efficient credit structure

Use our trade finance and supply chain finance apps to manage payment arrangement with your supplier

Collaborate with your suppliers and bank counterparts

Trusted by 100+ global companies

Manage global risk

CPG Company achieves accurate settlements while reducing time spent on daily reconciliations by 50%

Unmatched treasury client and industry experience

Deep industry and domain expertise

A track record in product development

Multi-market and global cross-asset coverage

Enhanced productivity

One platform with best of breed solutions

Achieve better business outcomes

Cloud-based enterprise software provider Eka to transform corporate...

Eka acqui-hires banking and finance tech start-up Trxiea and Devanshu Bhatt joins leadership team as SVP, Treasury Solutions.

Move to automated and continuous financial reconciliation

Simplify critical finance reconciliations across ledgers and accounts for faster and more accurate close process management.