The speed of digital transition in the recent years has been unprecedented, with a few technology leaders accomplishing 18-month transformation plans in almost over a weekend. There are still plenty who are nostalgic for the good old undigitized times. That said, when it comes to survival and growth, a digital future supported by automation is not only inevitable but necessary.

Blocked! Obstacles faced in making treasury automation a reality

The speed of digital transition in the recent years has been unprecedented, with a few technology leaders accomplishing 18-month transformation plans in almost over a weekend. There are still plenty who are nostalgic for the good old undigitized times. That said, when it comes to survival and growth, a digital future supported by automation is not only inevitable but necessary.

Automations, unlike humans, enable your processes to function 24/7 with real-time visibility and 100% accuracy. Companies all over the world are realizing efficiencies to be gained through automation – cutting costs, eliminating manual tasks, and allowing employees to focus on higher-value responsibilities and such. According to a survey, 78% of business leaders posit that automation can free up to 3 work hours a day.

The case for ERP connectivity and automation in treasury

Treasury departments too need to harness the power of automation. The starting point for this transformation is automating the connectivity to Enterprise Resource Planning (ERP) systems. Currently, treasurers use disparate ERP systems to get data and for repetitive tasks such as manual data entry. This data is used for critical functions including cash management, cash forecasting, working capital management and treasury risk management. Automating ERP will help treasurers save time and effort. It’s a gateway to centralized data that allows the business to have a single source of truth for decision-making.

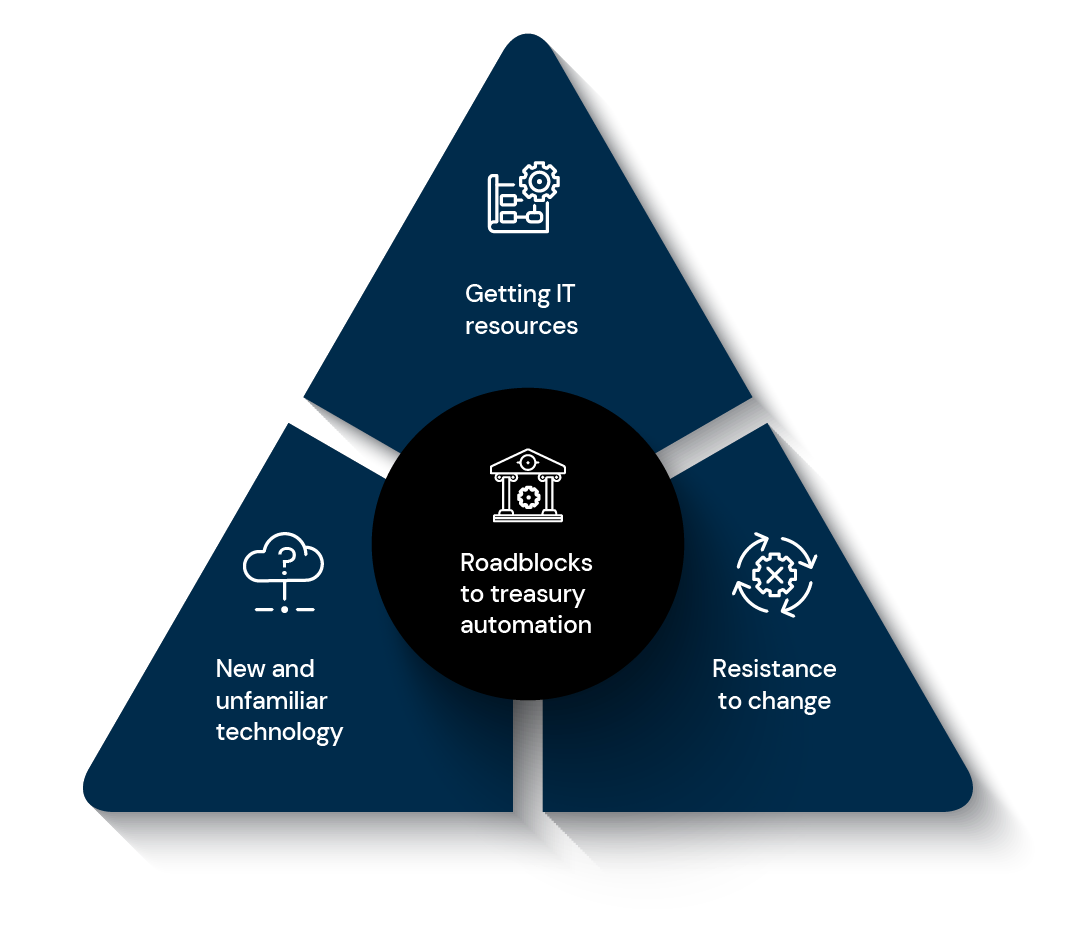

Obstacles to achieving automation in corporate treasuries

When considering treasury automation solutions, treasurers might face these barriers:

1. Getting IT resources

To get IT resources greenlit, treasury teams are tasked with justifying the need for ERP automation. This means that the team needs to make a strong business case as to why automation in ERP is crucial for them. It’s also important to research on what exactly is needed to get in the treasury automation going in a way that works for the business. In most cases, teams will realize that they don’t need system overhauls but instead can make-do with connectors in the form of Application Programming Interface (APIs).

2. New and unfamiliar technologies

Not all treasury teams are familiar with the latest technology trends. Tech jargon like ‘AI’, ‘Machine Learning’ or ‘API’ might make the team feel like they’re out of their depth and become a barrier to finding the right solution to help their ERP connectivity needs.

3. Resistance to change

Some teams might have an “if it ain’t broke, why fix it?” attitude. Meaning, creating any change in processes is met with a lot of resistance because the old way works just fine. Here, teams are willing to pay the price of inefficiency while keeping employees trapped in repetitive tasks rather than elevating them to strategic roles.

Why ERP connectivity is key to treasury automation

The path to seamless treasury automation lies in ERP connectivity. APIs can act as modern automation software which helps enhance treasury processes. Using APIs, disparate ERP systems can be connected in a way that provides treasury teams with much needed visibility and on-demand connectivity.

Examples of ERP connectivity helping treasury functions:

Accurate cash forecasts

Raw data stored in ERP systems such as sales orders, purchase orders, general ledger account balances, and outstanding invoices organized in a structured way makes data extraction easier. To get the most out of the cash forecasting process, it is essential to constantly compare forecasted values against transactional data by performing variance analysis, which improves the accuracy of the forecast.

Quicker bank reconciliation

Bank statements can be compared with commitments and projections received from ERP, to detect anomalies.

Consolidated view of working capital

Poor global working capital management due to disparate systems can lead to massive cash trapping in dead assets and other issues. Data pulled from ERP and fed into a cloud platform will allow treasurers to get a consolidated view of working capital and optimize cash conversion cycle.

Conclusion

It’s essential to understand how automation can truly benefit teams working in treasury management. This knowledge can help the team overcome obstacles and obtain ERP connectivity for a successful treasury automation. Read our free e-book to get an in-depth understanding of how treasury automation can be enabled with seamless ERP connectivity.

Other resources

Money matters: why bank connectivity is a boon for treasurers

Any good treasurer knows that the ball is always rolling. As an engaged treasurer, it’s essential to keep tabs on the company’s financial health anytime, anywhere.

Cash visibility: Emerging technology trends for 2022 and beyond

Cash management is one of the core functions of treasury. In simple terms, it means the process of collecting and managing cash flows to ensure optimum liquidity and maximized returns for business.

Any good treasurer knows that the ball is always rolling. As an engaged treasurer, it’s essential to keep tabs on the company’s financial health anytime, anywhere.

Cash management is one of the core functions of treasury. In simple terms, it means the process of collecting and managing cash flows to ensure optimum liquidity and maximized returns for business.