The old adage ‘Cash is king’ is probably losing its significance fast in the post-pandemic world as treasurers worldwide scramble to gain a clean, transparent and more accurate understanding of their cash positions globally.

Global cash visibility becomes more critical than ever to build a real-time treasury

The old adage ‘Cash is king’ is probably losing its significance fast in the post-pandemic world as treasurers worldwide scramble to gain a clean, transparent and more accurate understanding of their cash positions globally. Undoubtedly, gaining ‘real time bottom up’ visibility of consolidated cash available in multiple bank accounts (across different geographies, currencies and organizational structures) is critical for efficient treasury cash management.

According to PwC Global Treasury Benchmarking Survey of treasurers, 26% of global cash is not visible to corporate treasury on a daily basis.

Quite often than not, treasurers are stuck with out-of-date, old cash positions leading to inaccurate forecasts, inefficient utilization of working capital, wrong hedging strategies and more.

End result – Loss of strategic opportunities for treasurer and a continuous cycle of short-sighted bad decisions at the CFO/Board level.

What’s stopping the treasures from having access to decision critical, real-time cash visibility?

Most organizations continue to function with decentralized treasuries operating on a disjointed ERP system model, with multiple banking relationships scattered across the globe.

Collating this huge volume of complex data and bringing it to a ‘unified point of reference’ with no standardized formats and limited third-party connectivity, is a highly arduous task for treasurers. In addition, overreliance on spreadsheets for manual forecasts and reporting means unwarranted consolidation errors and reconciliation delays.

End result – Inaccurate, incomplete data with severely compromised credibility and relevance.

What’s the actual need of the hour?

The immediate solution though appears to be technology, should ideally not be the first step.

To begin with, treasuries must focus on getting their organization’s internal processes in order. Moving from decentralized to centralized treasury in a phased manner is the need of the hour. Although there is no one size fits all approach to achieve phased centralization, it fundamentally starts from unifying critical treasury operations, processes and policies – the most critical one being cash and risk management.

Standardization and improved timeliness of underlying cash data will bring in huge benefits – real time global cash visibility, accurate cash flow forecasting and quick cash reporting due to real time bank reconciled cash position.

The second phase could focus on centralization of hedging, foreign exchange and interest rate risk management processes leading up to a fully centralized treasury.

The next step towards achieving global cash visibility can then focus on implementing a unified treasury management system which will help in:

- Automation of several critical but repetitive operational tasks such as bank reconciliation, cash reporting and more, via Robotic process automation (RPA).

- 360 degrees interfacing with banks in real time via open API’s – including open banking API’s prevalent in Europe – providing treasurers instant visibility into multiple accounts simultaneously. It will also help them drive intra-day reporting rather than cash positioning based on previous day reporting.

- Predictive data analysis via algorithms driven by Artificial Intelligence (AI)/Machine Learning (ML) which will help with historical pattern identification necessary for accurate cash forecasting and payment anomaly detection.

- Real-time dashboards capable of user defined enrichments for deriving key insights.

End Result: 360 degrees’ real time cash visibility

What new opportunities can open up for treasurers with real time cash visibility?

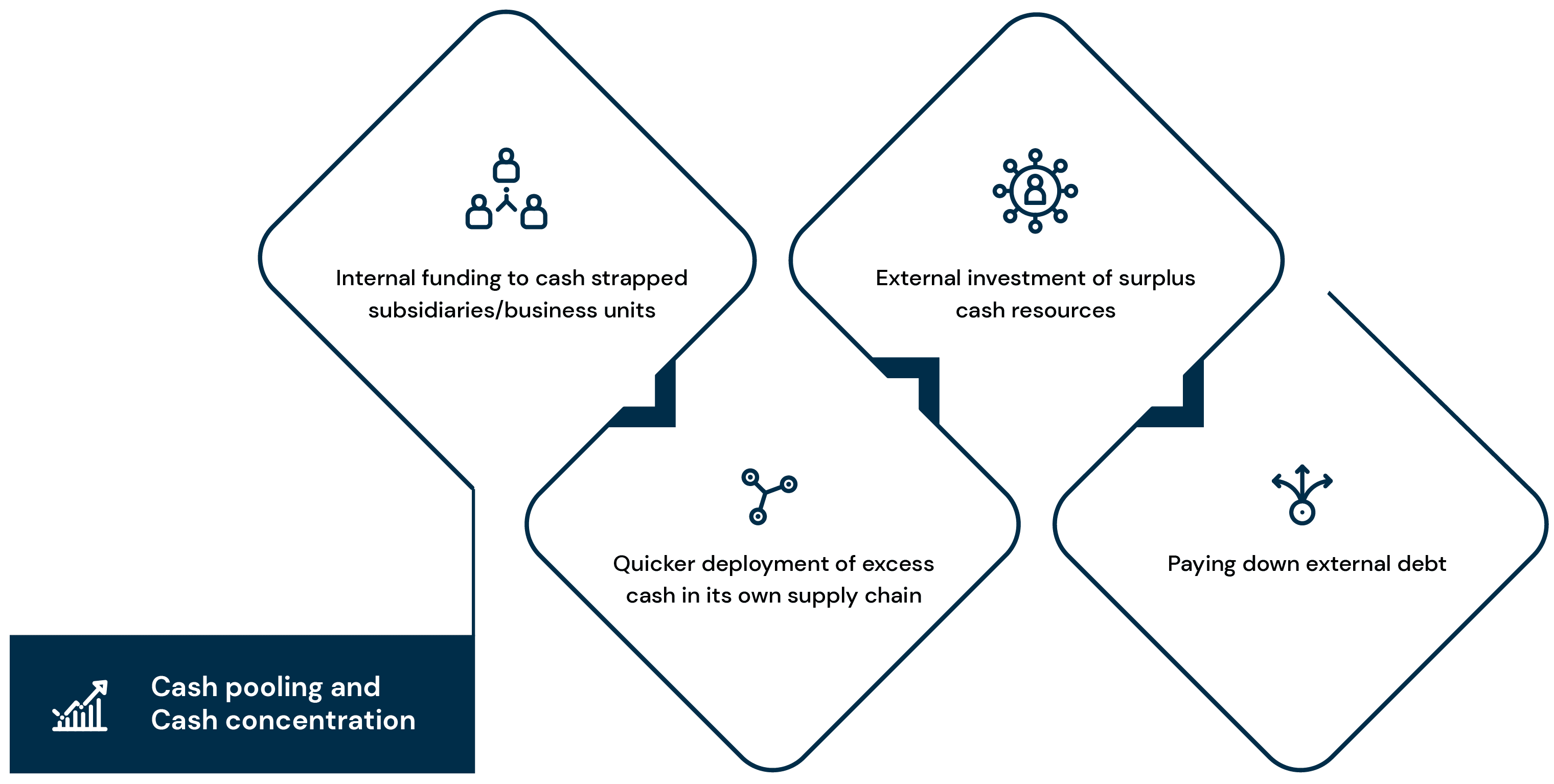

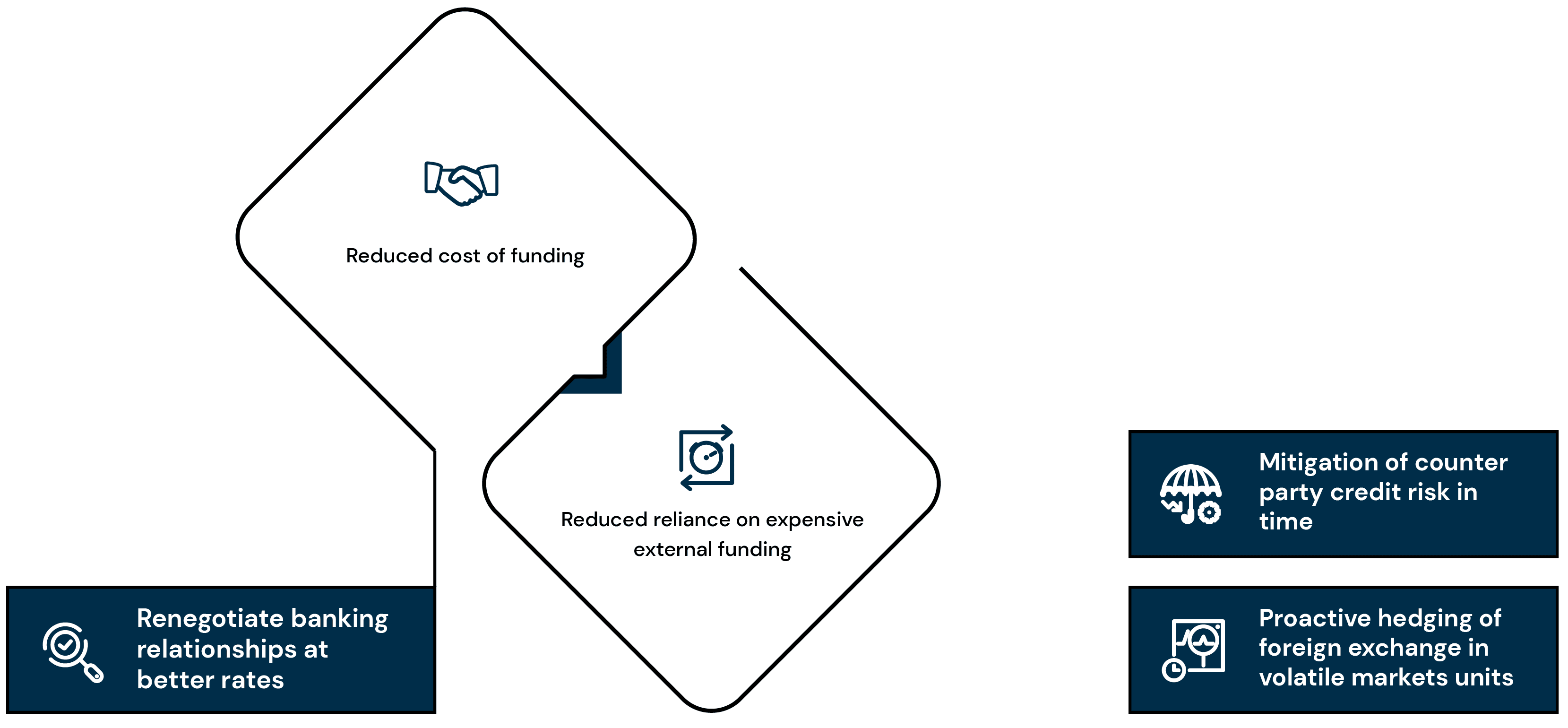

Access to real time cash visibility can be a real game changer as it helps empower treasurers with the freedom to explore strategic opportunities and improve ROI. Case in point:

Going forward:

To continue being a strategic advisor to the CFO and retain their seat at the table, especially as businesses strive to economically recover from the Covid-19 pandemic, it’s imperative that treasurers begin dealing with their limitations around cash visibility in a timely and phased manner.

It goes without saying that clean, accurate and real-time data that helps treasurers gain 360 degrees’ cash visibility should be a top priority towards achieving a real-time efficient treasury.

That said, going forward, knowing only global cash visibility in isolation will not be sufficient for treasurers to optimally mobilize and deploy cash resources. They will need a holistic picture with full visibility into the entire spectrum of working capital – banking credit lines, debt, foreign exchange, hedging, liquidity, payables and receivables which will only be possible when all the related treasury processes are centralized.

Other resources

Cash Management

Ascertaining accurate cash position across location, currency and liquidity position can be monumental. Gain global cash visibility across regions and disparate data sources on one single platform with Eka’s Cash Management app.

Leveraging dashboards, analytics and reporting to optimize cash management

Information that does not impact decisions is just that, information. Analytics and reporting that impact decisions deliver treasury intelligence.

Ascertaining accurate cash position across location, currency and liquidity position can be monumental. Gain global cash visibility across regions and disparate data sources on one single platform with Eka’s Cash Management app.

Information that does not impact decisions is just that, information. Analytics and reporting that impact decisions deliver treasury intelligence.