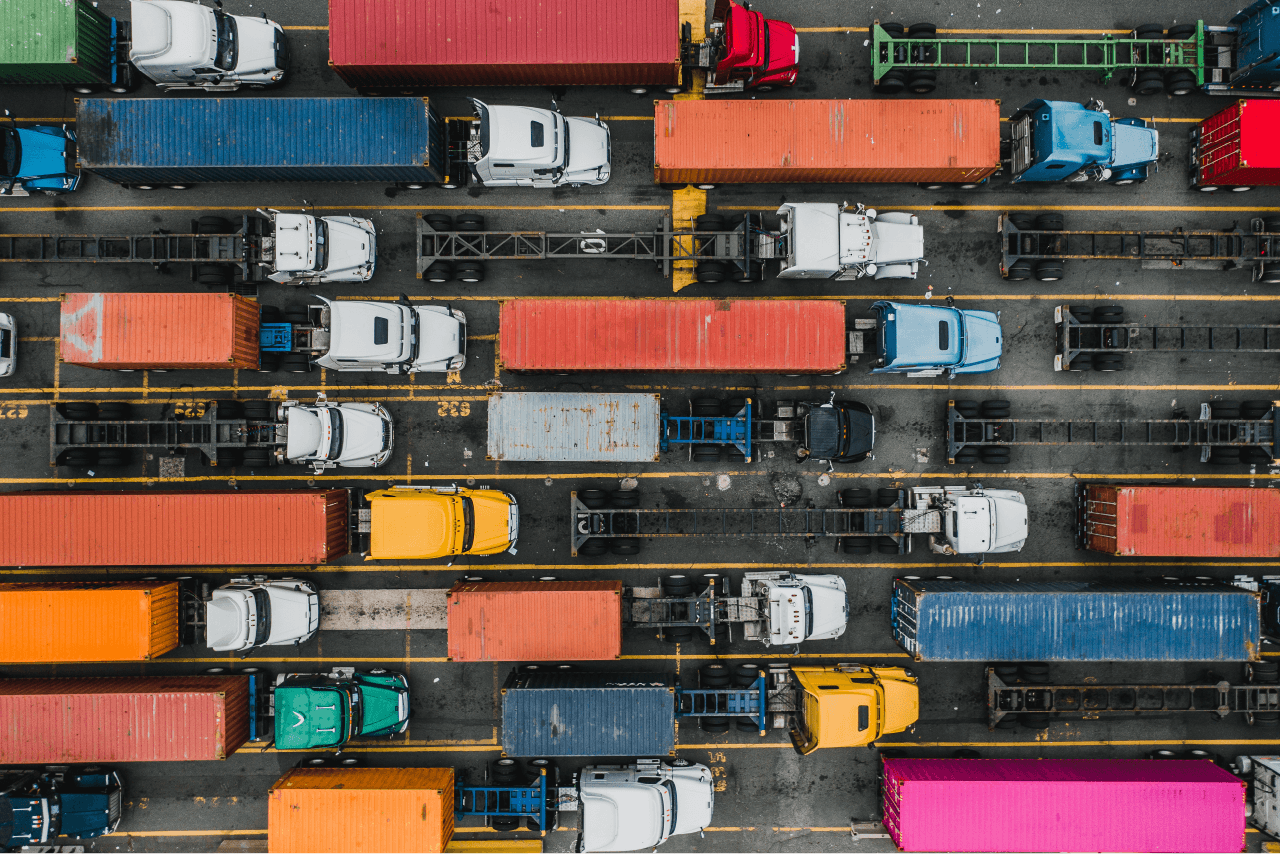

Both soft and hard commodity companies are continuously exposed to multiple risks associated with increasingly volatile markets, changing regulations, competitive economies, climate changes, and more.

Managing risk for soft and hard commodities

Both soft and hard commodity companies are continuously exposed to multiple risks associated with increasingly volatile markets, changing regulations, competitive economies, climate changes, and more.

While some companies across the soft and hard commodities markets are able to adapt to the rapid changes, the majority of companies are struggling to identify and respond to market risks, operational risks, compliance risks, and credit risks. As a result, there is a growing need for enhanced risk strategy, analytics and reporting capabilities, database management and governance.

According to an article by EY, “Risks will become increasingly interdependent, intersecting with each other in new and unexpected ways, triggering and amplifying each other in complex chain reactions. They will spread within organizations and across their ecosystem with much greater velocity than today. The process will be exponential, not linear — risks will appear gradually, and then suddenly become critical.”

As suggested, it is difficult – if not impossible – to predict which stimuli in the economy will uncover vulnerabilities at different points in time. Managing risk for soft and hard commodities is a cyclical process that challenges leaders to constantly evaluate and adapt. To better prepare, make sure that you and your team are asking the critical questions around visibility, types of risk exposure, and how to prioritize these risks for your organization. Some questions to consider include:

How are you managing market price risk?

According to a survey of over 100 medium to large manufacturers, 92% of companies use complex pricing structures and 100% of them manage pricing fully or partially in spreadsheets. More than 95% of the companies we have spoken to run some or all of their commodity risk on spreadsheets.

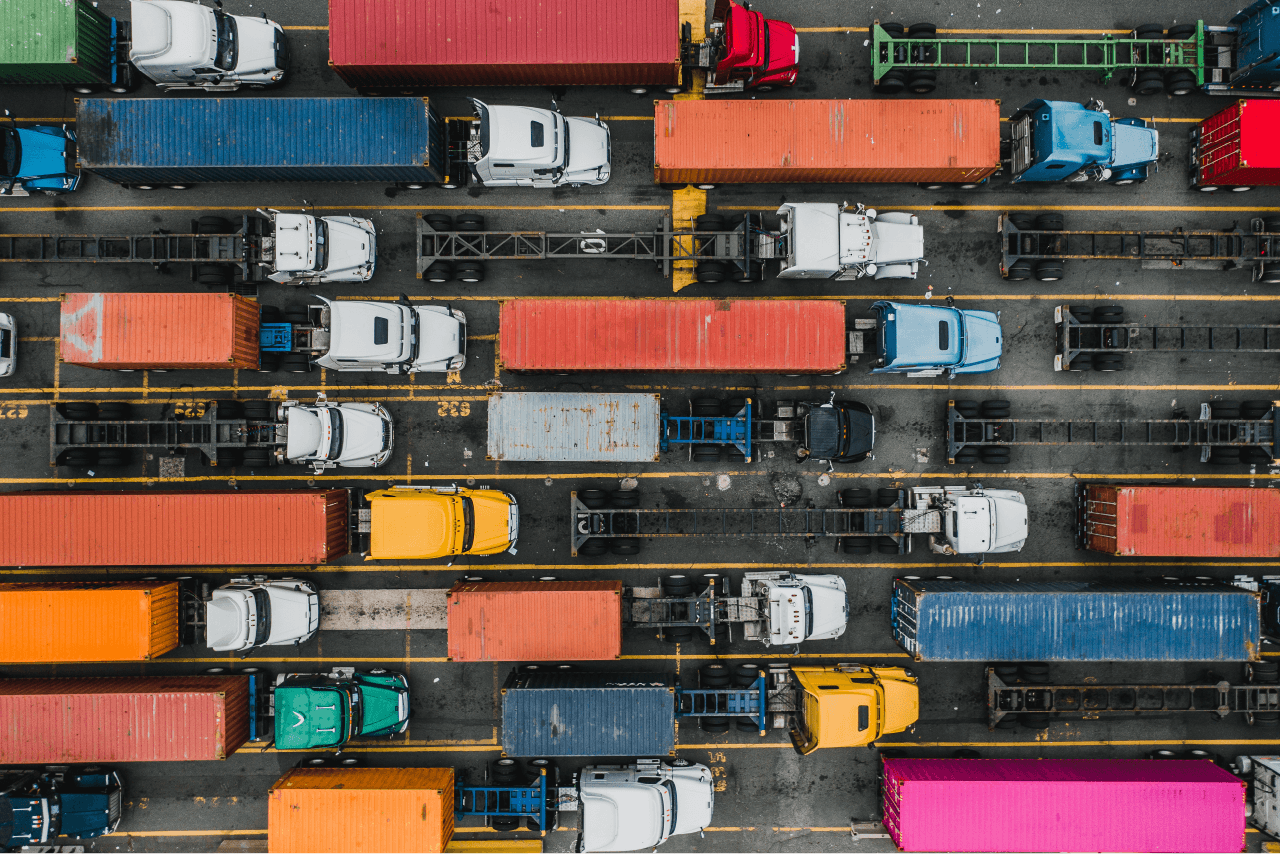

Hard and soft commodities markets are extremely volatile; prices constantly fluctuate due to imbalance in supply and demand, lengthy lead time to respond to changes in supply demand, and other macro factors such as trade wars, climate change, and regulatory changes. Commodity trading companies usually hedge their commodity exposure via derivative transactions to mitigate risks. Despite their hedging, they cannot eliminate the risks entirely. Having an adequate solution in place to manage market price risk is essential.

Where is your team misaligned on regulatory compliance risk?

To comply with changing financial regulations like IFRS9, US GAAP, ASC 815, you have to overcome the challenge of understanding how these complex standards impact hedging and regulatory compliance.

Deloitte’s 2016 Global Foreign Exchange Survey of 133 companies found that 60% of the participants felt their currency hedges were hurt by a lack of visibility driven by complexity and inadequate investments in automation. Ernst & Young found similar results in their study, Expecting More from Risk Management, which found that companies lose opportunities due to the inability to recognize and manage the uncertainties in today’s volatile environment.

Every company that deals with soft and hard commodities is exposed to fluctuations in interest rates, exchange rates or commodity prices. An enterprise will always have natural hedges but, in most cases, it is necessary to manage risks proactively using analytics tools. Companies simply can’t optimize hedging strategies using spreadsheets or ad hoc isolated systems built on legacy technology. Hedging, when done effectively, can help stabilize cash flows and revenue.

Do you have the agility to mitigate fast-moving risks?

Operational risks can often take shape quickly. For example, delays in the completion of shipment due to breakdowns, default in payment due to association with unsanctioned counterparty partners, or external factors such as pandemic lockdowns causing increase in prices of exports often result in an immediate need for an agile solution.

Soft and hard commodities companies often need capabilities beyond what their legacy CTRM systems can offer. Modular, cloud-based systems are specifically designed to help soft and hard commodities firms mitigate operational risks with the added benefits of strong data management and security governance.

IT security, or regulatory compliance, it’s important to make sure that businesses governing soft and hard commodities are analyzing their ability minimize complexities and manage risks.

Other resources

Commodity trading platform 101: How to solve common challenges

Whether you already have a legacy commodity trading platform in place and you feel like it consistently misses the mark or your implementing a solution for the first time…

Why automation is mission critical now

In an article published by Gartner, analysts note that their 2020 view of hyperautomation has changed in 2021 because COVID-19 has caused an acceleration of digital strategies.

Whether you already have a legacy commodity trading platform in place and you feel like it consistently misses the mark or your implementing a solution for the first time…

In an article published by Gartner, analysts note that their 2020 view of hyperautomation has changed in 2021 because COVID-19 has caused an acceleration of digital strategies.